China’s biggest electric vehicle company, BYD, entered Europe with high hopes. However, it faced slow sales and several challenges due to a weak dealer network, limited hybrid options, and a lack of local market knowledge.

Quick Response to Fix Mistakes

To solve these issues, BYD quickly made changes. They hired European executives with strong local experience and expanded their dealer network. BYD especially focused on recruiting talent from European auto companies like Stellantis.

Hybrids Now Part of the Plan

In December, BYD announced that plug-in hybrid cars would be a key part of their European strategy. Alfredo Altavilla, a special advisor to BYD, played a major role in this decision. He explained that many European buyers still prefer hybrids over fully electric cars.

High-Level Hires from Stellantis

Altavilla, a former Fiat-Chrysler executive, joined BYD in August 2024. He brought in several experienced managers, such as Maria Grazia Davino for Germany, Alessandro Grosso for Italy, and Alberto De Aza for Spain. These hires came with attractive salary packages and career growth opportunities.

Leadership Shift and New Targets

BYD also replaced its European head Michael Shu with Stella Li, its No. 2 global executive. Shu had predicted a 5% market share, but BYD only reached 2.8% in 2024, selling 57,000 vehicles. The company hopes to boost its performance with a new production plant in Hungary.

Why Europe Matters for BYD

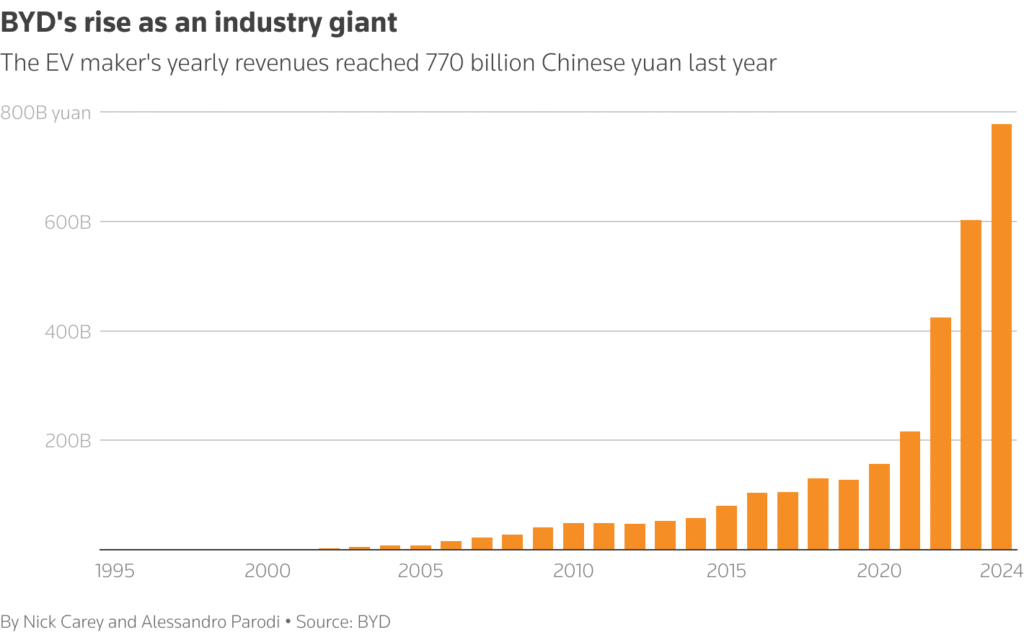

BYD’s urgency to grow in Europe comes from its strong growth in China. Sales in China rose to 4.2 million vehicles in 2024. BYD even overtook Tesla to become the top EV seller globally. However, due to heavy competition and price wars in China, global expansion is now essential.

Learning from the Mistakes

Industry experts believe BYD has learned from its early mistakes. Tim Albertsen, CEO of European leasing company Ayvens, said that BYD is serious about Europe but must understand that growth here takes time.

Sales Are Rising

BYD’s efforts seem to be paying off. In the first quarter of 2025, BYD sold over 37,000 vehicles in Europe, including the UK. This is a big jump from the 8,500 units sold in the same period last year.

Adapting to Customer Needs

In China, BYD is known for adapting quickly to consumer demands. For example, in February, BYD made its advanced driver-assist technology “God’s Eye” available for free in all its models, including low-cost ones.

Strong Display at Shanghai Auto Show

At the 2025 Shanghai Auto Show, BYD showed off new models like the low-cost Seal 06 and Sealion 06, as well as the luxury SUV Yangwang U8L and the Denza Z sports car concept. The large display highlighted BYD’s strength and ambition.

Poor Market Understanding Slowed Early Growth

BYD didn’t do enough research before entering Europe. For example, it sponsored Euro 2024 and advertised itself as the top “NEV” maker—a term common in China but unknown to most Europeans.

Dealer Network Too Small at Launch

In Germany, Europe’s largest car market, BYD sold fewer than 2,900 vehicles in 2024. One major issue was that their dealer network was too small, with only 27 dealers. BYD now plans to grow that number to 120.

Europe is Not One Market

Former managers said BYD made the mistake of treating Europe like a single market. But Europe is made up of many countries with different preferences. One ex-manager compared it to “frogs in a pan,” all jumping in different directions.