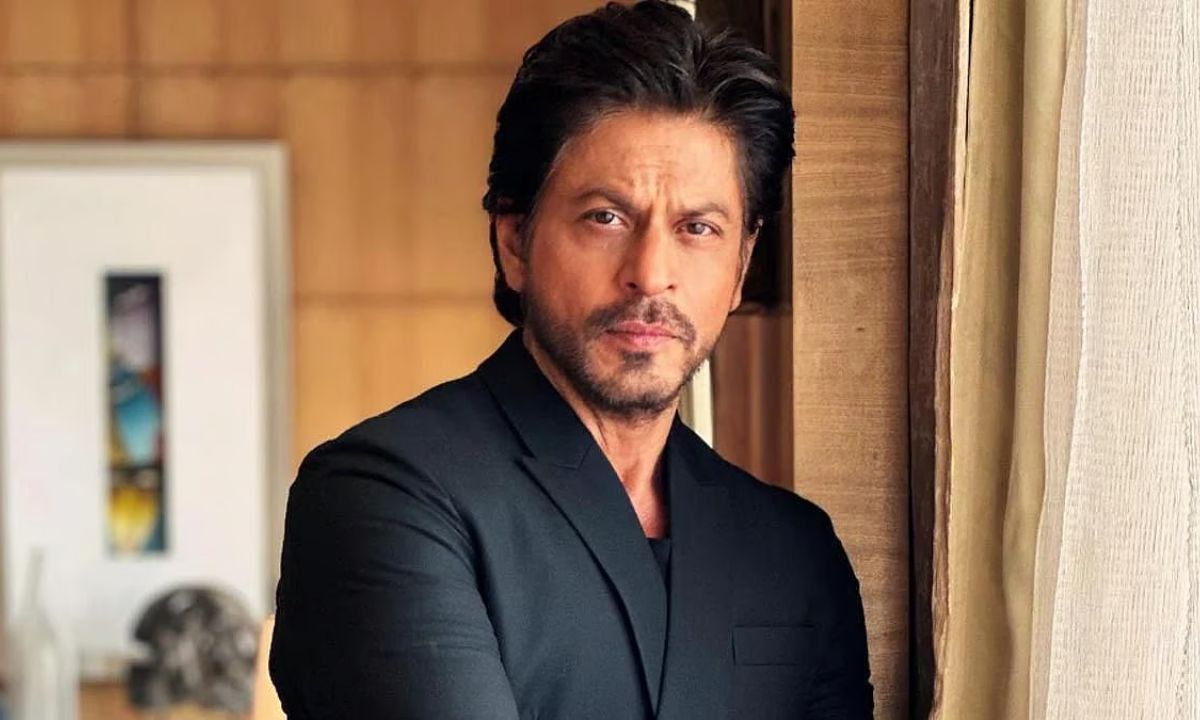

Mumbai – Bollywood superstar Shah Rukh Khan has received relief in a ₹10 crore tax evasion case. The Income Tax Appellate Tribunal (ITAT) ruled in Khan’s favor, dismissing legal proceedings initiated by tax authorities for the financial year 2011-2012, according to Indian media reports.

The case was related to his earnings from the film Ra.One, where authorities claimed he had not paid taxes in India. In his 2012-2013 income tax return (ITR), Khan had declared earnings of ₹83.42 crore. However, the Income Tax Department reopened the investigation, alleging that he had concealed details and provided incomplete financial information.

The tribunal ruled that the reassessment by tax authorities was legally invalid, leading to Khan’s victory in the case.

The Tax Dispute Over Ra.One

The dispute centered on Khan’s remuneration for Ra.One. As per his agreement with Red Chillies Entertainment, 70% of the film was shot in the UK, meaning that 70% of the earnings were to be accounted for abroad, with the remaining in India.

Khan was paid ₹10 crore for the film, which he received through a UK-based company. Red Chillies deducted ₹1 crore as TDS before transferring the money to the UK firm, which further deducted ₹1.40 crore before handing over ₹7.6 crore to Khan.

Khan declared this income as foreign earnings and paid ₹2.7 crore in taxes in the UK. However, the Indian tax authorities argued that this arrangement led to a loss of tax revenue for India and initiated an investigation. The assessing officer (AO) claimed this was a case of tax evasion.

The Income Tax Department rejected Khan’s claim for foreign tax credit, which he had filed in his ITR. However, in its ruling, the tribunal bench—comprising Sandeep Singh Karhail and Girish Aggarwal—declared the proceedings against Khan illegal, giving the actor a significant legal victory.