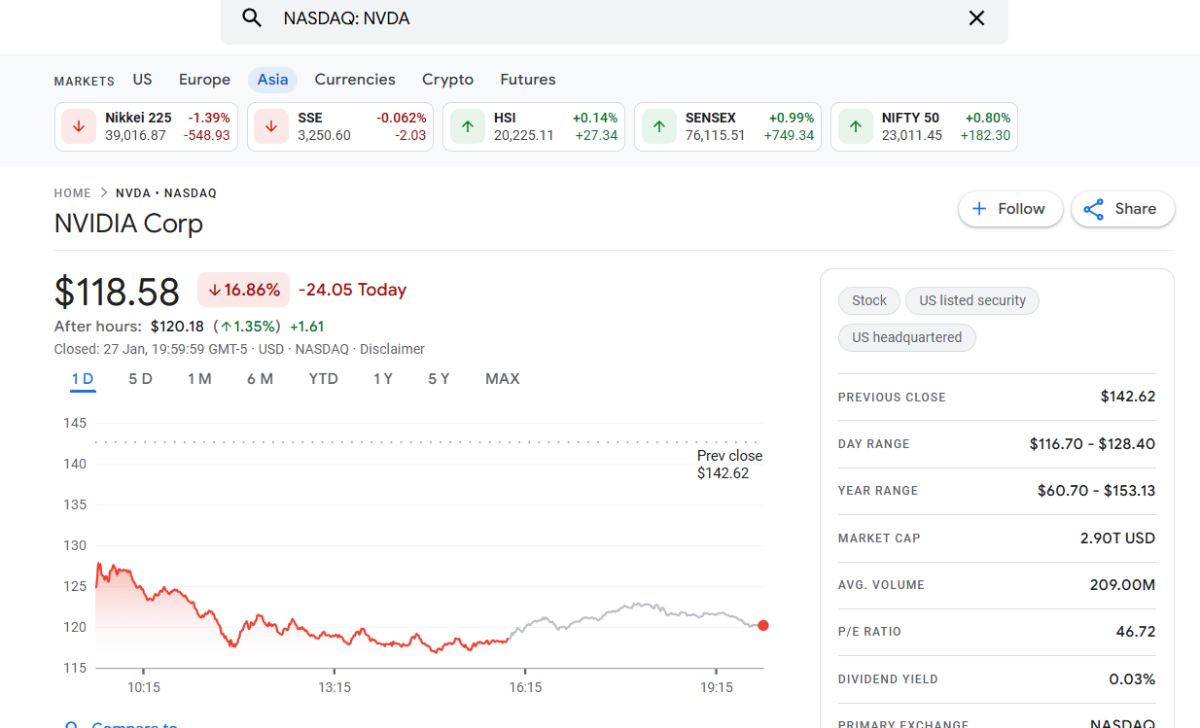

US tech giant Nvidia faced a sharp decline in its stock value on Monday, losing nearly 17% of its market capitalization. The sudden drop came in the wake of DeepSeek, a Chinese AI chatbot, rapidly gaining popularity in the US and disrupting the global AI landscape. But why did Nvidia, a key player in AI chip production, suffer such a significant blow?

What Is DeepSeek and How Did It Impact Nvidia?

DeepSeek, an AI chatbot developed at a fraction of the cost of its competitors, debuted last week and quickly became the most downloaded free app in the US. The technology behind DeepSeek is powered by the DeepSeek-V3 model, which reportedly cost just $6 million to train, significantly undercutting the billions spent by rivals like OpenAI.

This cost-efficiency, coupled with claims of performance on par with industry leaders, has raised concerns about the viability of expensive AI infrastructure. Nvidia, whose chips are integral to many advanced AI systems, saw its stock plummet as investors questioned the profitability of its high-end AI chips in a market where cheaper alternatives are emerging.

Why Is DeepSeek a Threat to Nvidia’s Business Model?

Nvidia has dominated the AI hardware market, supplying advanced GPUs crucial for training large AI models. However, DeepSeek’s success highlights a shift in the industry: Chinese developers have found ways to create AI systems that require far less computational power.

DeepSeek’s developers reportedly used a mix of Nvidia’s high-end A100 chips—acquired before US export restrictions—and less powerful, widely available chips to achieve their results. This approach suggests that AI models can be developed more cost-effectively, potentially reducing demand for Nvidia’s premium products.

Fiona Cincotta, senior market analyst at City Index, remarked, “If you suddenly get this low-cost AI model, then that’s going to raise concerns over the profits of rivals, particularly given the amount they’ve already invested in more expensive AI infrastructure.”

What Are the Broader Implications for Nvidia?

DeepSeek’s launch not only affected Nvidia but also sent shockwaves through other tech firms reliant on AI. Broadcom, another AI chipmaker, saw its shares fall by over 17%, while Microsoft and Google experienced declines of 2% and 4%, respectively. In Europe, companies like Dutch chipmaker ASML also faced significant losses.

Despite these challenges, some analysts believe Nvidia retains a competitive edge due to its access to advanced chip technologies unavailable to Chinese firms. Wall Street bank Citi noted, “In an inevitably more restrictive environment, US access to more advanced chips is an advantage.”

Is Nvidia’s Stock Likely to Recover?

While Nvidia’s stock took a hit, the long-term impact remains uncertain. The US government’s $500 billion pledge to build AI infrastructure could bolster demand for Nvidia’s products domestically. Additionally, DeepSeek’s reliance on Nvidia’s A100 chips highlights the company’s continued importance in the AI supply chain.

However, the rise of cost-efficient AI models like DeepSeek has introduced new uncertainties. As the industry adapts to this emerging competition, Nvidia’s ability to innovate and maintain its dominance will be closely watched by investors.