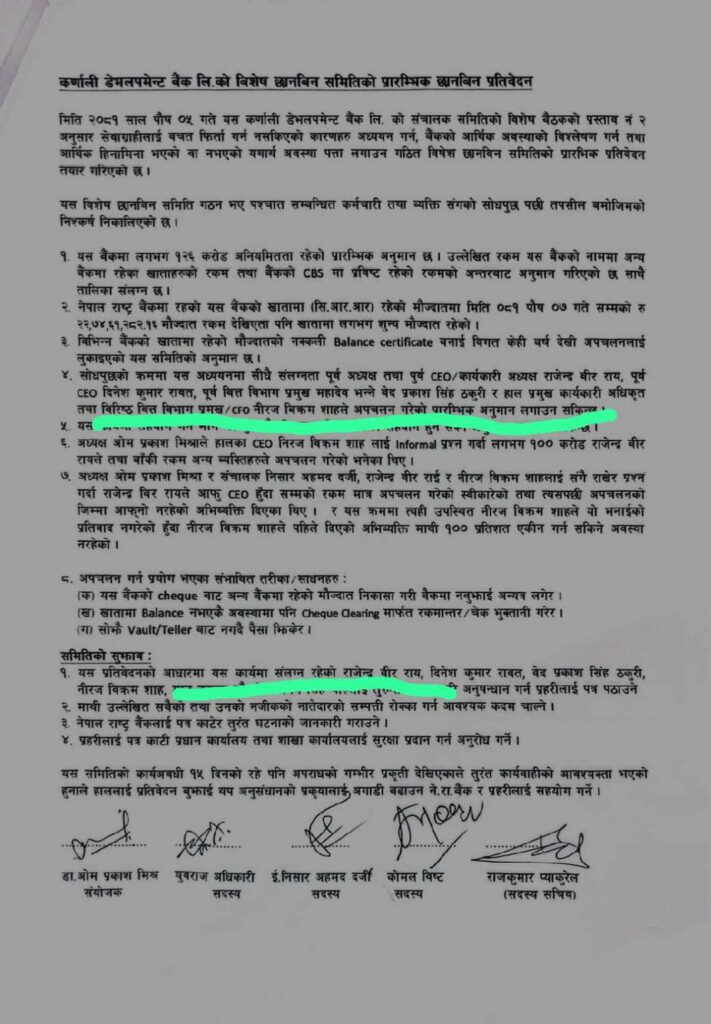

The former and current executives of Karnali Development Bank, headquartered in Nepalgunj, have been implicated in a financial misappropriation of approximately NPR 126 crore. The accused include the former executive chairperson, former and current CEOs, and a former finance department head. This discrepancy was uncovered by a special investigation committee led by Board Chairperson Dr. Om Prakash Mishra.

The committee found significant inconsistencies between the bank’s account balances in other banks and the entries in its Core Banking System (CBS).

The investigation committee, formed on Poush 5 under Dr. Mishra’s leadership, prepared a preliminary report and submitted it to the District Administration Office, Banke, District Police Office, Banke, and the Financial Supervision Department of Nepal Rastra Bank on Poush 8.

According to the report, the primary accused are:

- Former Executive Chairperson and CEO Rajendra Bir Raya

- Former CEO Dinesh Kumar Rawat

- Former Finance Department Head Bed Prakash Thakuri

- Current CEO and Finance Department Head Niraj Bikram Shah

The report estimates that Raya misappropriated approximately NPR 70 crore, while Rawat, Thakuri, and Shah each embezzled NPR 20 crore. During a joint interrogation, Raya and Shah reportedly admitted their involvement.

The investigation revealed that the accused withdrew funds from the bank’s accounts in other banks using checks but did not deposit the money back into the bank. They also:

- Cleared checks for accounts with insufficient balances to divert funds.

- Directly withdrew cash from the vault and teller counters.

- Created fake bank balance certificates.

- Altered documents using Photoshop to fabricate reports for regulatory authorities.

For instance, the CBS showed a balance of NPR 22.74 crore in the bank’s Cash Reserve Ratio (CRR) account at Nepal Rastra Bank as of Poush 7, 2081. However, the actual balance was nearly zero.

The misappropriation came to light during a Nepal Rastra Bank (NRB) inspection in Mangsir 2080. The NRB supervisory team had instructed the bank to provide original deposit documents from other banks by Shrawan 2081.

Despite an internal committee’s findings being submitted to the District Police Office, Banke, the details remain undisclosed as the NRB continues its investigation. SP Tul Bahadur Karki of Banke Police stated that legal action would proceed under prevailing laws if requested by the NRB.

Karnali Development Bank, established in 2060 BS, has faced governance issues and financial crises, prompting Nepal Rastra Bank to classify it as problematic on Poush 10. NRB has since taken over the bank’s management.

Key accused Rajendra Bir Raya holds an 80% stake in the bank and served as its Executive Chairperson and CEO for 15 years. Dinesh Kumar Rawat was CEO from Chaitra 2076 to 2079, while Niraj Bikram Shah has been serving as CEO since Asar 2080 after working as the finance department head for five years.

The bank suffers from poor governance, high non-performing loans (NPLs), and capital deficits. Official figures show an NPL ratio of 40.8%, whereas the bank reported only 7.26% until the end of Ashoj.

A three-member management committee, led by NRB Deputy Director Tikaram Khatri, has been appointed to oversee the bank’s operations. The committee will:

- Conduct due diligence audits (DDAs).

- Manage the bank’s assets and liabilities.

- Initiate legal action against those involved in the embezzlement.

The Karnali Development Bank operates 18 branches across Banke, Bardiya, and Dang districts. With NPR 500 crore in deposits and NPR 300 crore in loans, the bank is grappling with misuse of public savings, rendering it unable to return deposits.

The NRB aims to protect public interests by prioritizing deposit payments, loan recovery, and necessary legal actions against the culprits.